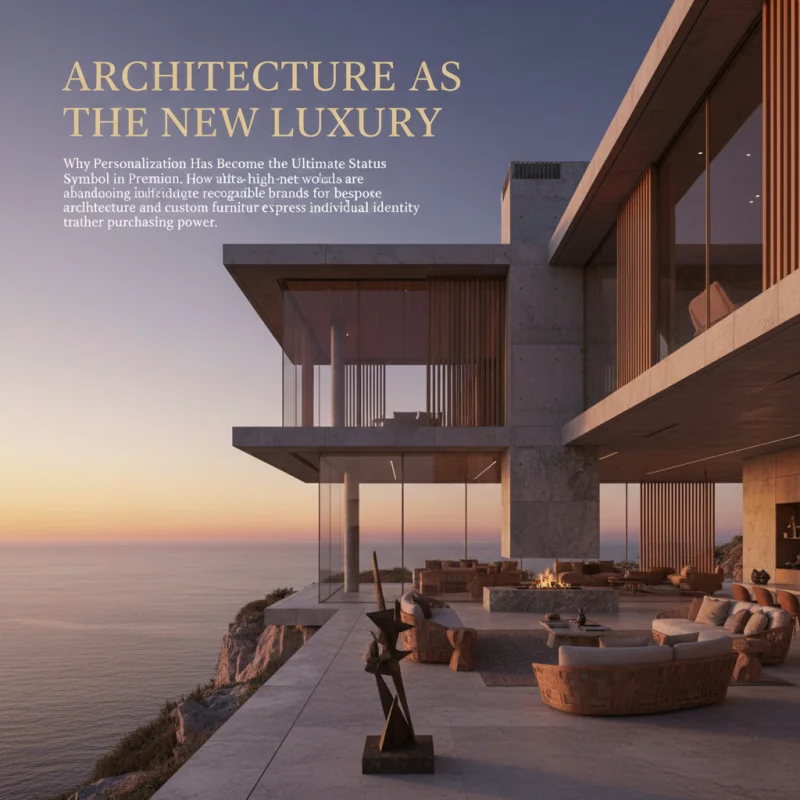

Why the world’s most sophisticated investors are treating architectural excellence not as consumption but as appreciating assets—and what this means for the future of ultra-premium real estate

Published: December 2025 | Reading Time: ~14 minutes | Category: Luxury Investment & Architecture

The conversation started as they often do in our Dubai office—a client asking what seemed like a straightforward question about furniture for his new villa in Emirates Hills. But as we discussed wood species, joinery techniques, and long-term durability, the conversation shifted in an unexpected direction.

“I’m not really buying furniture,” he said, looking at samples of rosewood and teak spread across our conference table. “I’m buying an asset. Twenty years from now, when my children inherit this villa, I want them to inherit something that has appreciated, not depreciated. The furniture, the architecture, the design—all of it needs to be investment-grade.”

This wasn’t the first time I’d heard this perspective, and it certainly wouldn’t be the last. But it crystallized something fundamental that’s been transforming luxury real estate and architecture over the past decade. For an emerging class of ultra-high-net-worth individuals, residential architecture is no longer simply where you live. It’s become a genuine asset class, evaluated and acquired using the same rigorous investment criteria applied to art collections, vintage automobiles, or fine wine portfolios.

Understanding this shift matters enormously if you’re creating, commissioning, or investing in luxury architecture. The rules have changed. The metrics have evolved. What constituted luxury residential real estate twenty years ago—or even ten years ago—no longer applies. A new paradigm has emerged, and those who understand it early will capture extraordinary opportunities while those who miss it will find themselves creating properties that, despite enormous budgets, fail to hold value in evolving markets.

The Fundamental Shift: From Consumption to Investment

Traditional luxury real estate thinking treated residential properties as consumption assets. Yes, they might appreciate due to land value or market dynamics, but the structures themselves—the buildings, the architecture, the design—were understood as depreciating assets. Like automobiles, homes were expected to require constant updating, renovation, and eventual replacement to maintain relevance and value.

This model made sense in an era when architectural fashion changed rapidly, when construction quality was inconsistent, when the luxury market prioritized novelty over enduring quality. Wealthy families expected to substantially renovate homes every decade or two, updating kitchens, bathrooms, and finishes to match current trends.

But something fundamental has shifted among the world’s most sophisticated property owners. They’ve begun asking a different question: what if we created architecture designed not to require constant updating but to appreciate over time like other collectible assets?

This question emerges from several converging realizations. First, many ultra-wealthy individuals have experience collecting art, watches, classic cars, or other appreciating assets. They understand the characteristics that make objects investment-grade—exceptional craftsmanship, limited availability, documented provenance, timeless design that transcends temporary fashion. They’ve started asking why residential architecture shouldn’t embody these same qualities.

Second, environmental consciousness has made the disposable approach to architecture morally questionable. The waste generated by constantly demolishing and rebuilding, the carbon emissions from perpetual construction, the resource consumption of treating homes as temporary rather than permanent—it’s become increasingly difficult to justify, particularly for individuals who position themselves as environmentally responsible.

Third, and perhaps most pragmatically, the costs of constant updating have become prohibitive even for the very wealthy. Renovating a 10,000 square foot villa to contemporary luxury standards might cost ₹5-8 crores. Doing this every decade means spending ₹50-80 crores over a fifty-year ownership period just maintaining relevance. The financial logic of creating something timeless from the start becomes compelling.

These forces have created a new category of luxury residential architecture designed explicitly as investment assets—buildings intended to appreciate in value, designed to remain relevant for generations, created with the same attention to enduring quality that characterizes museum-quality art or vintage Patek Philippe timepieces.

The Characteristics of Investment-Grade Architecture

What distinguishes investment-grade architecture from merely expensive buildings? Through extensive work with clients approaching residential property as investment, we’ve identified seven characteristics that consistently appear in architecture designed to appreciate rather than depreciate.

Timeless Proportion and Composition

Investment-grade architecture avoids trendy forms and proportions that will date the building to a specific era. Instead, it employs classical principles of proportion that have proven enduring across centuries. This doesn’t mean buildings must look historical or traditional—many contemporary buildings achieve timelessness through restrained modernism that avoids the stylistic quirks marking specific decades.

We recently consulted on a villa project in Bangalore where the architect had initially designed a very 2020s contemporary form—lots of cantilevered volumes, dramatic angles, extensive glass. Beautiful, certainly, but almost certainly dated-looking in fifteen years. We pushed for a more restrained approach using classical proportions but contemporary materials and detailing. The result looks current but won’t scream “designed in the 2020s” the way the original scheme inevitably would have.

Timeless proportion extends to interior spaces. Room sizes and ceiling heights that feel generous without being excessive, window proportions that balance light with privacy, circulation patterns that feel natural and efficient—these fundamental qualities outlast any specific finishing style.

Material Excellence and Permanence

Investment-grade architecture employs materials selected not just for immediate beauty but for how they’ll age over decades. This often means natural materials like stone, solid hardwood, and bronze that develop patina and character rather than deteriorate. It means avoiding materials that will look tired in ten years or require replacement in twenty.

The furniture we create for these projects follows the same philosophy. We use solid timber—rosewood, teak, walnut—species that improve with age. We employ traditional joinery that can be tightened or repaired rather than glued joints that fail permanently. We finish with treatments that can be refreshed without complete refinishing.

This material permanence has financial implications that sophisticated investors understand immediately. A villa faced in natural stone that weathers beautifully for centuries is fundamentally different from one clad in materials requiring replacement every fifteen years. The life-cycle costs differ dramatically, but so does the investment character of the asset.

Documented Provenance and Craftsmanship

Just as collectible art requires documentation of artist, date, materials, and previous ownership, investment-grade architecture increasingly comes with comprehensive provenance documentation. Who designed it? Who built it? What materials were used and where did they originate? What techniques and technologies were employed?

We maintain detailed records for every piece of furniture we create—photographs of construction process, documentation of wood sources, records of artisans involved, descriptions of techniques employed. This documentation adds value by establishing authenticity and quality, but also by creating narrative that makes pieces more interesting and valuable.

Architectural provenance works similarly. A home designed by a recognized architect, built by craftspeople with documented expertise, using materials with verified sustainable sourcing, documented through professional photography and detailed specifications—this documentation transforms a building from anonymous construction into a documented work of architecture.

Flexibility Within Permanence

A paradox of investment-grade architecture is that it must be simultaneously permanent and flexible. The structure, proportions, and primary spatial qualities should be timeless and unchanging. But the building must accommodate evolving needs and technologies without requiring fundamental reconstruction.

We design this flexibility into furniture through modular systems and thoughtful detailing. A sectional sofa can be reconfigured for different room layouts. A dining table can extend for larger gatherings. Storage furniture includes adjustable shelving and removable dividers. The pieces remain fundamentally themselves while adapting to changing needs.

Buildings employ similar strategies. Generous room sizes accommodate varying furniture arrangements and uses. Service systems are designed for easy upgrading without demolishing finishes. Structural systems allow for future modifications without compromising integrity. The architecture provides a permanent framework flexible enough for evolving lifestyles.

Sustainable Systems and Materials

Investment-grade architecture must demonstrate environmental responsibility, both for moral reasons and because sustainability increasingly affects value. Buildings with poor energy performance, materials from questionable sources, or systems requiring frequent replacement face growing stigma in luxury markets.

Forward-thinking clients now request comprehensive environmental documentation—energy modeling, material life-cycle assessments, water consumption projections, carbon footprint calculations. This information affects both present value and future marketability.

The sustainability commitment must be genuine rather than performative. Investment-grade architecture achieves environmental performance through fundamental design decisions—building orientation, thermal mass, natural ventilation, daylighting—not just through applying green technologies to otherwise inefficient designs.

Integration of Art and Architecture

Investment-grade residential architecture often blurs boundaries between building and art collection. Architecture becomes gallery for displaying collectible art, but the architecture itself is created with artistic intention worthy of the collection it houses.

This integration appears in details and craftsmanship that reward close inspection. A staircase becomes sculpture, with joinery and material execution that demonstrates virtuoso craftsmanship. A wall finish employs traditional techniques—Venetian plaster, tadelakt, lime wash—requiring skills rarely found in contemporary construction. Custom furniture incorporates artistic elements—carving, inlay, sculptural forms—that elevate pieces from functional objects to artistic statements.

The integration means architecture and furnishings are conceived together rather than sequentially. We increasingly work with architects from project inception, ensuring furniture design informs architectural detailing and vice versa. The result is coherent whole where architecture, interior architecture, and furniture feel inseparable.

Scarcity and Exclusivity

Investment assets derive value partly from scarcity—there are only so many Picassos, only so many vintage Ferraris, only so many properties in prime locations. Investment-grade architecture creates scarcity through uniqueness and location rather than artificial limitation.

Every commission we execute is unique, created specifically for particular clients and particular spaces. We never repeat designs—each piece represents singular creation that cannot be replicated. This inherent scarcity contributes to investment value.

Architecturally, scarcity comes from combining exceptional sites with exceptional execution. A beautifully designed villa in an ordinary location has limited scarcity value. A generic villa in an exceptional location benefits from location scarcity but not architectural scarcity. True investment-grade properties combine both—remarkable architecture in remarkable locations.

The Financial Mechanics: How Architecture Actually Appreciates

Understanding that investment-grade architecture can appreciate in value is one thing. Understanding the actual mechanisms through which this appreciation occurs is another. Let’s examine the specific ways exceptional architecture creates and captures value over time.

Location Value Amplification

All real estate benefits from location scarcity and desirability. But exceptional architecture amplifies location value rather than simply riding it. A mediocre building in a prime location captures some location value. An exceptional building in the same location captures substantially more.

We’ve seen this pattern repeatedly in markets we serve. In Dubai’s Palm Jumeirah, two villas of similar size in similar locations might differ in value by forty to sixty percent based purely on architectural quality and interior execution. The location provides baseline value that both properties share. The exceptional architecture of one property amplifies that value substantially.

This amplification compounds over time. As a neighborhood matures and develops character, the exceptional properties become the defining examples that establish the neighborhood’s luxury credentials. They become the properties featured in design publications, shown to potential buyers as examples of neighborhood quality, referenced in pricing discussions for other properties.

Cultural Capital and Social Positioning

Beyond financial metrics, investment-grade architecture generates what sociologists call cultural capital—prestige, recognition, social positioning that has real economic value. Properties featured in Architectural Digest or Wallpaper* magazine, properties that host charity events or cultural gatherings, properties associated with prominent individuals—these accrue cultural capital that translates into financial premium.

The furniture and interiors we create contribute to this cultural capital. When pieces appear in design publications, when they’re discussed by design influencers, when they become reference points for design discussions, they contribute to the overall cultural capital of the properties they furnish.

This cultural capital proves particularly valuable when properties eventually sell. Buyers don’t just acquire square footage and location—they acquire association with recognized aesthetic quality, documented design pedigree, cultural cachet that elevates their own social positioning.

The Collector’s Market

An emerging market segment treats exceptional residential architecture the way collectors treat art or classic cars—as objects of desire worth acquiring even at substantial premiums. These collector-buyers seek properties not primarily for living (though they may well live in them) but as investments and expressions of taste.

This collector’s market changes valuation dynamics fundamentally. Traditional real estate valuation compares properties based on quantifiable features—location, size, condition, amenities. But collector-driven markets value qualities that resist quantification—aesthetic brilliance, design innovation, craftsmanship excellence, cultural significance.

A villa created by recognized architect using exceptional materials and craftsmanship might command prices fifty to one hundred percent above “comparable” properties in traditional valuation metrics. But in collector’s market, there are no truly comparable properties—the uniqueness itself creates value.

We’ve experienced this firsthand with furniture created for specific properties. In several cases, when properties have sold, the custom furniture we created has been specifically valued in sale negotiations, with buyers willing to pay substantial premiums to retain it. The furniture transcends mere furnishing to become integral part of the property’s collectible value.

Adaptation to Alternative Uses

Investment-grade architecture often proves adaptable to alternative uses that create additional value. Exceptional private residences can function as event venues, film locations, design showcases, or boutique hospitality properties, generating income streams beyond simple appreciation.

This flexibility has become increasingly important in luxury markets. Owners want properties that can earn returns if they’re not personally occupying them. Architecture designed only for private residence limits these options. Architecture created with institutional-quality craftsmanship and design opens multiple possibilities.

A villa we furnished in Dubai now operates part-time as a luxury event venue, generating substantial income when the owners travel. The exceptional interiors and furniture—designed originally for private family use—prove perfectly suited for hosting corporate events and private celebrations. The property generates returns unimaginable for a merely expensive but unexceptional villa.

Case Studies: When Architecture Becomes Investment

Theory matters, but actual examples make abstract concepts concrete. Let me share several projects where architectural and interior investment has demonstrably created financial value beyond traditional real estate appreciation.

The Mumbai Collector’s Residence

A client in South Mumbai commissioned a complete renovation of a heritage apartment, engaging a renowned architect for spatial reconfiguration and us for all custom furniture and interior elements. Total investment including our work approached ₹12 crores for a 4,000 square foot apartment.

Many people considered this investment excessive for a leasehold property. Traditional valuation would suggest maybe ₹8 crores maximum for even the finest apartment in that building. But our client wasn’t thinking traditionally—he was creating a collector’s piece, documented through professional photography, featured in multiple design publications, furnished with museum-quality custom pieces.

Four years later, family circumstances required selling the property. It sold in three weeks for ₹18.5 crores—more than twice the original purchase price plus renovation investment, in a market where comparable apartments had appreciated perhaps fifteen percent over the same period.

The premium? Buyers weren’t purchasing an apartment. They were acquiring a documented piece of design excellence, photographed and published, furnished with custom furniture by recognized craftspeople, representing a complete aesthetic vision rather than assembled components.

The Bangalore Villa Project

A technology entrepreneur commissioned a villa on a premium plot in Bangalore’s Whitefield area. Rather than building to maximize square footage, he engaged an architect focused on proportion, light, and material quality. The resulting 8,000 square foot villa could have been 12,000 square feet on the same plot, but restraint was deliberate.

We created all furniture specifically for the villa—dining furniture, bedroom suites, living room pieces, study furniture. Each piece was documented photographed during construction, with full provenance records. Total furniture investment was ₹85 lakhs.

The villa was completed in 2019 at total cost of ₹8.5 crores including land. In 2024, the owner received an unsolicited offer of ₹16.5 crores from a buyer who’d seen the villa featured in design media. He declined, but the offer established market value at nearly double his all-in cost in five years.

Comparable villas in the same area—larger, built to maximize square footage, furnished with purchased rather than custom pieces—had appreciated perhaps thirty percent over the same period. The discipline of creating investment-grade architecture, the documentation and publishing, the custom furniture with provenance—these created value far exceeding normal market appreciation.

The Dubai Investment Property

A different model entirely: a Dubai investor commissioned a Palm Jumeirah villa explicitly as income-producing asset. Rather than treating it as personal residence, he approached it as investment requiring optimization for returns.

This meant creating interiors sophisticated enough to command premium short-term rental rates while being durable enough for high-traffic use. We created furniture using hospitality-grade construction techniques but residential-quality aesthetics—pieces that could withstand intensive use while looking bespoke and luxurious.

The villa generates approximately AED 1.2 million annually in short-term rental income—roughly double what comparable villas achieve. The premium comes entirely from interior quality and furniture that allows marketing at the highest tier of luxury rentals.

The owner’s interior investment was approximately AED 2.5 million beyond standard developer finishes. That investment generates incremental revenue of roughly AED 600,000 annually compared to comparable properties—a return exceeding twenty percent purely from rental premium, not including property appreciation.

Implementation Strategy: Creating Investment-Grade Architecture

Understanding that exceptional architecture can function as investment is valuable. Knowing how to actually create it requires different knowledge entirely. What follows is practical guidance for clients, developers, and architects seeking to create investment-grade properties.

Start with Investment Thesis

Before any design begins, articulate why this property should appreciate beyond normal market dynamics. What will make it collectible? What will distinguish it from comparable properties? What will create cultural capital? What story will it tell?

This investment thesis should be specific and documented. Not “we want a beautiful home” but “we’re creating a villa that synthesizes traditional Indian craftsmanship with contemporary minimalist aesthetics, documented through professional photography and scholarly writing, positioned as reference example of this design synthesis.”

The thesis guides all subsequent decisions. Materials are selected not just for beauty but for how they support the thesis. Architects and artisans are chosen for credentials that add provenance value. Documentation strategies are planned from project inception.

Invest in Design Excellence

Investment-grade architecture requires exceptional design, which typically means engaging recognized architects and designers whose participation adds value. This doesn’t necessarily mean celebrity architects—it means professionals with documented expertise, published work, and reputations for quality.

The design investment should be proportional to overall project ambition. For a ₹10 crore project, allocating ₹50-75 lakhs to architecture and interior design isn’t excessive—it’s appropriate for creating investment-grade results. The design investment itself becomes part of project value and should be documented as such.

Our furniture follows the same principle. Clients investing ₹40-60 lakhs in custom furniture for a property aren’t buying furniture alone—they’re buying documented craftsmanship, design provenance, and the story that adds value to the overall property.

Document Obsessively

Investment assets require documentation. Art has certificates of authenticity, provenance records, and conservation documentation. Architecture should have equivalent rigor.

This means professional photography throughout construction showing materials, techniques, and craftsmanship. It means maintaining detailed specifications and material documentation. It means creating narrative—written descriptions of design intent, material selections, technical innovations.

We provide comprehensive documentation for all custom furniture—construction photographs, material source records, artisan information, technique descriptions. This documentation proves authenticity and quality, but also tells stories that make pieces more interesting and valuable.

The documentation should be compiled into permanent record—physical or digital portfolio that future owners can reference. This portfolio becomes part of property value, demonstrating the thought and investment that created it.

Plan for Stewardship

Investment assets require proper maintenance to preserve and enhance value. This means creating maintenance protocols, establishing relationships with qualified conservation professionals, planning for inevitable repairs and updates.

The furniture we create comes with detailed maintenance guidance—how to clean different materials, when professional refinishing is needed, how to address minor damage before it becomes major problems. Properties require similar guidance for architectural elements.

Consider establishing relationships with professionals who can provide ongoing care—architects for major decisions, interior designers for refreshing elements, craftspeople for repairs and maintenance. Investment-grade architecture isn’t create-and-forget—it requires active stewardship.

The Future: Architecture as Financial Asset

The trend toward treating exceptional architecture as investment asset will accelerate rather than plateau. Several dynamics make this evolution inevitable.

Wealthy families are increasingly sophisticated about alternative investments. Having diversified beyond traditional stocks and bonds into art, classic cars, watches, wine, and other collectibles, residential architecture represents logical expansion of investment thinking.

Environmental and social responsibility considerations make disposable architecture increasingly unacceptable. Creating buildings designed to last centuries rather than decades aligns with sustainability values while providing financial benefits.

Documentation and authentication technologies—from blockchain provenance records to digital twins—make it easier to establish and maintain value records for architectural assets, supporting market development.

Most fundamentally, as more exceptional architecture proves its investment value through actual appreciation and transaction data, more clients will approach commissioning with investment frameworks, creating virtuous cycle of quality and value.

For those creating luxury residential architecture—whether as architects, developers, or artisans like ourselves—understanding these dynamics isn’t optional. The clients driving tomorrow’s luxury markets think about architecture as investment. Meeting their needs requires different approaches, different standards, different thinking.

But the rewards for getting it right extend beyond immediate financial returns. We’re creating architecture and furnishings designed to endure for generations, pieces that will be treasured not just by original clients but by their children and grandchildren. We’re creating work that contributes to cultural heritage, that preserves traditional crafts, that demonstrates contemporary excellence.

This is luxury with meaning. This is investment with legacy. This is architecture that matters.

For consultations on investment-grade custom furniture and interiors:

Tamil Nadu Workshop

355/357, Bhavani Main Road, Sunnambu Odai, B.P.Agraharam, Erode, Tamil Nadu 638005, India

Ireland Office

16 Leopardstown Abbey, Carrikmines, Dublin 18 D18YW10, Ireland

Contact: +91-8826860000 | +91-8056755133 | care@crosby.co.in